Talk to an ESG Expert about how Presgo can help you!

Our ESG Experts are on-hand to understand your ESG Reporting needs and cater our solution to you. Get in touch to discuss how we can help.

Talk to an ESG ExpertContents

- What is double materiality?

- Double Materiality vs Single Materiality

- Why does double materiality matter for businesses?

- What is the role of double materiality in CSRD compliance?

- How to Do a Double Materiality Assessment: Step-by-Step and Best Practices

- Example of Double Materiality Impact Assessment

- Incorporating Double Materiality into ESG Reports with Presgo

Double materiality is quickly becoming one of the most important shifts in sustainability reporting. Under the EU’s Corporate Sustainability Reporting Directive (CSRD), organisations are now required to assess not just how environmental, social, and governance (ESG) factors affect their finances, but also how their own activities affect society and the planet. This shift has prompted many organisations to ask what is double materiality and how it should shape their reporting approach.

Meanwhile, shifts in sustainability reporting in the UK suggest that companies may be inclined to adopt the double materiality approach, as seen in their European counterparts. This is in contrast to the UK’s traditional, single materiality perspective. In Europe, for example, recent research notes that 16 of 47 companies explicitly adopted double materiality in their reports in 2023, with a growing focus on long-term business resilience and societal impact. Meanwhile, 51% of companies in Asia-Pacific have adopted the double materiality approach as part of the region’s net-zero commitment.

For heavily regulated or impact-intensive sectors in the EU, such as energy or finance, double materiality is no longer an option but a strategic imperative. This guide will help explain what double materiality is, why it matters under the CSRD, and how to conduct a robust assessment that works for your organisation.

What is double materiality?

Double materiality is the view that materiality covers both financial relevance and the organisation’s broader impacts on stakeholders and society. In the context of CSRD double materiality, it’s the idea that a company’s sustainability-related disclosures should consider two distinct but related perspectives, often referred to when discussing double materiality meaning in ESG reporting:

Impact Materiality

Often referred to as the “inside-out” view, impact materiality is a company’s actual or potential effects (positive and/or negative) on people, the environment, or society that are connected to the company’s business, value chain, or operations. Sustainability matters identified through a CSRD double materiality assessment may require disclosure because the company’s activities meaningfully affect societal or environmental outcomes.

Financial Materiality

Also called the “outside-in” view, financial materiality refers to sustainability-related risks and opportunities that could reasonably be expected to affect the company’s financial condition, performance, or prospects, and subsequently impact the decisions of investors or other primary users of financial reports. This includes how sustainability issues such as regulatory changes, climate-related physical risks, and reputation loss may affect the company’s earnings, assets, liabilities, cost of capital, or business model.

Essentially, materiality becomes not only about what external factors do to a company’s operations or profitability, but also about how the organisation itself affects the environment and society. This dual lens is central to double materiality CSRD requirements and a defining feature of double materiality ESG approaches.

The concept of double materiality was introduced by the European Commission in its Guidelines on Non-Financial Reporting: Supplement on Reporting Climate-Related Information in 2019. In the guidelines, the European Commission highlights that the two risk perspectives already tend to overlap, and that they are “increasingly likely to do so in the future” according to evolving markets and public policies.

It’s important to note that for organisations and regions following other sustainability frameworks, materiality is handled differently. The GRI primarily uses impact materiality and does not require that a topic be financially material to the organisation, whereas the ISSB follows the traditional, financially focused single materiality approach.

Double Materiality vs Single Materiality

Making a clear distinction between single and double materiality helps clarify why CSRD-aligned reporting requires broader disclosures. While single materiality focuses solely on financially relevant information for investors, double materiality adds an outward-looking dimension that evaluates a company’s broader environmental and social impacts. The table below outlines how the two approaches differ across purpose, scope, and application:

| Aspect | Single Materiality | Double Materiality |

| Core focus | Looks only at how sustainability issues affect the company’s financial position and performance. The assessment stops at investor-relevant financial risks. | Looks at both how sustainability issues affect the company and how the company affects the environment, people, and broader society. Either lens can make a topic material. |

| Primary audience | Investors, lenders, and other users of financial statements. | Investors, regulators, communities, employees, and stakeholders whose interests go beyond financial value. |

| Scope of disclosure | Issues with a measurable financial impact on the company. | Issues that are financially material or have significant environmental or social impacts, even if financial effects are indirect or long-term. |

| Typical use | Used in traditional financial reporting frameworks such as the U.S. Generally Accepted Accounting Protocols (GAAP), with the scope focusing on enterprise value. | Required under the EU’s CSRD and implemented through the ESRS. The scope spans enterprise value and external impacts. |

| Sector specificity | Generally uniform across sectors, since financial reporting rules apply the same materiality threshold regardless of industry. | Highly sector-sensitive under the ESRS, recognising that sustainability impacts differ widely. For example, emissions and resource use drive materiality in mining or energy, while data privacy, digital inclusion, and governance issues are more material in finance or technology. |

Under single materiality, a company would report its carbon emissions only when those emissions create a clear financial consequence, such as exposure to carbon pricing, regulatory penalties, or higher operating costs.

Double materiality treats the same issue more broadly: emissions must also be disclosed when they have significant environmental or societal impacts, even if the financial effects are indirect or long-term. This shift reflects the core difference between the two approaches; single materiality captures what affects the company, while double materiality also captures what the company affects.

Why does double materiality matter for businesses?

As sustainability becomes an important part of business strategy, adopting the double materiality approach in ESG reporting helps keep organisations ahead of the market. For example, companies may gain access to sustainability- or ESG-related loans, green bonds, and ESG-focused investment funds by implementing double materiality in their ESG reporting process. Organisations adopting double materiality also earn consumer trust and loyalty by aligning with shifting sustainability preferences. Some more benefits of double materiality include:

Risk Mitigation

By conducting double materiality assessments, organisations can better identify, assess, and mitigate ESG risks such as supply chain disruptions due to extreme weather or reputational damage from poor labour practices. The holistic approach to materiality also provides companies with a broader scope of their impact, allowing businesses to proactively and preemptively manage emerging risks in an ever-evolving regulatory and compliance landscape.

Transparency

Double materiality also helps foster a more transparent approach to corporate and ESG reporting. In the long run, organisations and leaders can be more confident in how both financial and sustainability concerns are addressed.

Opportunity Identification

Double materiality often helps organisations spot sustainability-linked opportunities that might be missed under a purely financial lens. For example, organisations can identify opportunities to develop low-carbon products or services, enhance resource efficiency, or explore new business lines following a double materiality analysis.

Investor Trust

The double materiality process provides a wider net for an organisation’s sustainability efforts and caters to the interests of multiple stakeholders. This also helps organisations align with their sustainability efforts with the expectations of investors, customers, employees, regulators, and communities, fostering trust and long-term value creation.

As explained above, incorporating double materiality will look different across various sectors. In the finance sector, for example, a recent survey by the Taskforce on Inequality and Social-related Financial Disclosures (TISFD) revealed that financial institutions are warming up to the double materiality approach, highlighting the importance of adopting the impact materiality lens alongside the more traditional financial materiality.

Meanwhile, the U.S. mining industry has the Towards Sustainable Mining (TSM) initiative, which is recognised globally and offers a sustainability reporting framework addressing environmental and social risks with transparent performance assessments.

What is the role of double materiality in CSRD compliance?

Double materiality has become a cornerstone of sustainability reporting under the CSRD, helping organisations determine which ESG issues are most relevant for their businesses and stakeholders. It guides companies on what to assess, disclose, and prioritise, ensuring compliance while supporting broader sustainability objectives. The key CRSD double materiality guidelines include:

- Address the limitations of the NFRD and support the EU Green Deal

- Identify material sustainability issues through double materiality

- Inform ESRS-aligned reporting and assurance

- Tailor materiality to sector, business model, and ESG goals

- Deliver value to internal and external stakeholders

Aside from the CSRD, other reporting standards worldwide have also incorporated principles based on double materiality. This includes the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Carbon Disclosure Project (CDP).

How to Do a Double Materiality Assessment: Step-by-Step and Best Practices

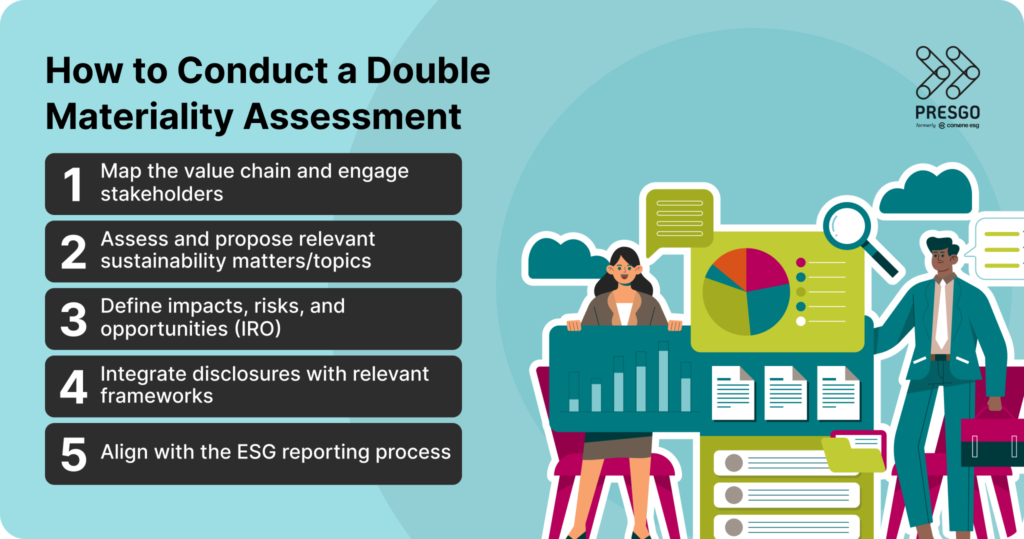

Step 1: Map the value chain and engage stakeholders

Use existing sustainability documents, climate risk assessments, and human rights due diligence reports to boost understanding of the company’s value chain and its key stakeholders. This involves reviewing the company’s website and external materials for relevant information and taking into consideration current legal and regulatory guidelines. This also includes internal and external stakeholders, from employees and suppliers to customers, investors, and community groups.

Best Practice: Conduct stakeholder mapping early in the process to identify interest and influence, and engage key groups through appropriate channels. This ensures your double materiality assessment captures both likely financial risks and actual or potential societal or environmental impacts, grounded in stakeholder reality rather than assumptions.

Step 2: Assess and propose relevant sustainability matters/topics

Begin with a list of potentially relevant sustainability matters throughout the organisation’s operations. For EU nations, the ESRS topic list can be a good starting point, along with other supporting sources like industry reports, existing sustainability frameworks, and competitor analysis. These matters, then, are typically finalised by the sustainability team together with subject matter experts and senior leadership, ensuring the list reflects operational realities, regulatory expectations, and strategic priorities.

Best Practice: Develop your topic list using multiple evidence sources, not just the ESRS, by combining industry benchmarks, peer disclosures, regulatory guidance, and internal risk registers. Validate the proposed topics with cross-functional teams to ensure you capture sector-wide issues as well as organisation-specific risks and impacts that may not appear in generic frameworks.

Step 3: Define impacts, risks, and opportunities (IRO)

Once specific material topics are finalised, you can narrow them down into subtopics and potential IROs. In materiality, Impacts, Risks, and Opportunities (IROs) need to be identified and evaluated. This includes impact analysis (impacts on people and the environment), risk analysis (sustainability-related risks to the company’s operations or reputation), and opportunity analysis (external factors that may impact the company’s operations or financial performance).

Some companies may also take the reverse approach, wherein all potential IROs are first identified across operations, then connected back to one of the ESRS’s subtopics. For instance, a manufacturing company outside the EU might treat energy use and greenhouse-gas emissions as an IRO under “climate change”, categorising its impact, risk, and opportunity accordingly under global frameworks such as the GRI.

Best Practice: Involve cross-functional teams (sustainability, operations, risk management, finance, legal) and stakeholder representatives when defining IROs. Also assess each IRO over short-, medium-, and long-term horizons while clearly documenting assumptions.

Step 4: Integrate disclosures with relevant frameworks

Once IROs are defined, organisations should align their double materiality assessment with the reporting frameworks most relevant to their jurisdiction and stakeholders. Globally, frameworks such as GRI, SASB, IFRS S1 & S2, and TCFD provide guidance for structuring disclosures that capture both financial and impact dimensions. For EU-based organisations, the ESRS under CSRD offers a region-specific example, enabling climate, social, and governance metrics to be mapped directly for compliance while remaining consistent with global reporting expectations.

Best Practice: Cross-map IROs to multiple frameworks where relevant to ensure that disclosures are comprehensive, auditable, and aligned with stakeholder needs.

Step 5: Align with the ESG reporting process

Once you have your double materiality data and insights, incorporate them into your company’s ESG reporting process. Materiality findings should be included in your ESG report under clear sections, with labelled data-backed disclosures on performance and progress. Establishing key performance indicators (KPIs) for both financial and impact risks and factors can also help boards and leadership develop action plans to address high-priority ESG issues, whether reducing carbon emissions or improving labour conditions.

Best Practice: Clearly link materiality findings to ESG reporting by defining measurable KPIs for both financial and impact-related issues, and ensure disclosures are evidence-based, well-labelled, and actionable to support board decision-making and strategic planning.

Example of Double Materiality Impact Assessment

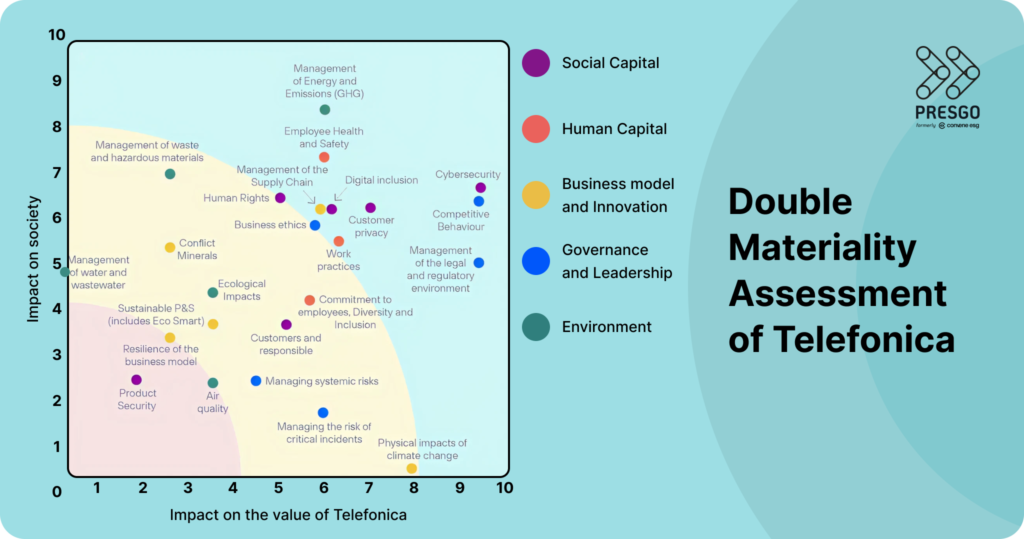

Aside from being detailed as part of the full double materiality report, double materiality assessments are also typically represented by scatter plot graphs or a double materiality matrix, with one axis representing the impact perspective and the other axis representing the financial perspective.

This categorisation of materiality throughout a business’s strategy and operations is visually depicted through the double materiality matrix. It provides a clear view of the significant and potential effects of an organisation’s activities on people and the planet, alongside how important these issues are for the business, making it a practical tool for double materiality analysis.

A double materiality assessment example is from Telefónica, a Spanish telecommunications company, which may deem greenhouse gas and carbon emissions as material from both an impact and financial materiality, while risk and critical incidents management is considered material only from a financial perspective rather than impact. More specific sustainability matters, like water and wastewater management, for example, may be considered material solely from an impact perspective. These are plotted accordingly on their materiality matrix from 2021, as shown above.

If the company followed the traditional single materiality approach, risk and critical incidents management would be disclosed, but not other sustainability matters that are deemed only material from an impact perspective, such as management of water and wastewater.

Incorporating Double Materiality into ESG Reports with Presgo

Double materiality is becoming a core principle for understanding a company’s real exposure to sustainability risks and its broader impacts. As more organisations adopt this approach, the key challenge is communicating these insights clearly to boards and stakeholders to support transparency and investor confidence.

Sustainability and ESG reporting still requires careful data collection, interpretation, and writing, and the right tools matter. Presgo, formerly Convene ESG, is Azeus’ AI-first, all-in-one ESG reporting solution, helping ESG teams around the world turn complex data into measurable insights.

Presgo’s double materiality assessment tool turns stakeholder input and business data into actionable insights for reporting and strategy. It supports structured IRO evaluation, allowing the setting of thresholds, time horizons, and severity levels, and produces audit-ready documentation with full traceability. It also includes features for mapping data to multiple global standards while remaining flexible for organisations outside the EU, making it useful for global ESG reporting and compliance efforts.

As environmental sustainability becomes more valued across businesses and sectors, double materiality is more than a compliance exercise; it’s a strategic framework for understanding long-term value creation and risk.

Book a demo now to learn more about how Presgo ensures consistency and clarity in your double materiality assessments aligned with trusted global frameworks.